Can a seller stay in their house after closing?

People often wonder if they can stay in their house after its closing date. The short answer is yes, this is possible when your real estate agent puts a sale-leaseback in the sales contract. Today we’ll talk more about what a sale-leaseback is, how to find sale-leaseback companies, and how you can get this extra time at your old house. You can also tap on the button below and chat with one of our real estate specialists today to find out how to do it!

How To Shop For “Sell and Stay Programs Near Me”

Shopping for sell and stay programs near you begins with a simple internet search. Simply look for leaseback or sell and stay programs online, which will show you will find everything from big box iBuyers to individual investors that buy homes. Though these programs each have unique terms and nuances, overall, the homeowner sells their home to an entity. Then, the entity leases the house back to the homeowner for an agreed-upon time. Conversely, the homeowner can sell their home to a private buyer who lets the homeowner stay in the home as a renter during a contracted “sale-leaseback” period.

How Do You Time a Home Sale Right?

Timing a home sale right is tricky and involves the expertise of a skillful real estate agent who has access to a variety of solutions. Combine selling an old home with building a new home and the stakes get even higher.

Many real estate agents need help make their client’s dreams come true while trying to sell their homes at market value to fund the new construction home’s down payment. Selling too quickly or too late causes problems either way. The seller is stuck paying two mortgages or left without a home for a season. However, when buyers access creative real estate solutions like a leaseback, or sell and stay program, they can sell their home for cash, use the cash to close, and stay in the home as a renter!

What is a leaseback in real estate?

A sale-leaseback is an agreement made between the homebuyer and seller that enables the seller to stay in their home as a renter after closing. In this situation, the homebuyer becomes the new owner and landlord while the seller becomes a temporary renter.

The duration of a sale-leaseback is typically short, and it starts immediately on closing day and ends when agreed upon in the purchase contract’s post-occupancy agreement. Sellers that need a flexible move-in timeline for their new home prefer a leaseback, even if it’s just a couple of days after closing.

What’s in a leaseback transaction?

A leaseback transaction contains an agreement between the homebuyer and seller regarding renting the recently sold home. It should include all necessary details about the rent-back period. It’s a shortened version of a traditional lease agreement but includes everything that should protect both the new renter and the homeowner. Here are some of the terms you will find in one:

Lease Duration: When it starts and ends.

- If there is a delayed closing, these terms may need to be amended.

Identifying the type of lease: whether it’s short-term, month-to-month, or long-term.

Rent Cost:

- When tenants should pay rent.

- If the leaseback is free, that fact should be clear in the document.

Security Deposit Terms

- Amount of security deposit.

- Conditions on how to get the deposit back.

- Conditions upon when the deposit is forfeited.

Final walk-through details & rules.

- Terms of eviction (rare but needs to be stated).

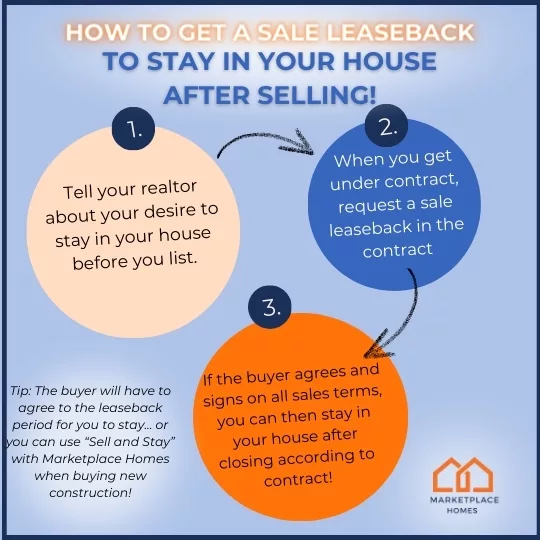

How to Get a Rent-Back Agreement

To get a rent-back agreement, you must get a post-occupancy agreement in the contract. Preferably, this should be in the ratified purchase agreement. It should never be a last-minute request as the home buyer may not feel the need to agree to it.

Alternatively, you can find a brokerage that buys your first home and rents it to you for a set period of time. These sale-leaseback companies are backed with funds to enable the use of your former primary residence as a rental as you wait for the right time to move.

Sell and Stay

Marketplace Homes’ Sell and Stay program will buy your home and let you stay in it as a renter when you buy a new construction home. Whether your new home will be ready in a matter of weeks or months, you can access up to 80% of your home’s value now and receive the upside when the home sells on the open market.

Unlike other residential sale-leasebacks, Sell and Stay includes an option contract, which gives you the right to repurchase the home for a price agreed upon in the transaction. That’s right — you can lease as long as you’d like. Then, if you change your mind at any time during the lease term, you can buy it back.

Who benefits from a sale-leaseback?

Both home sellers and buyers can benefit from a rent back. The home seller gets extra time to move, which is beneficial when they are waiting for a new construction dream home to be ready. Sometimes, the leaseback period is free, which means they don’t aren’t responsible for rent or mortgage payments.

For the new homeowner, they can get rental income for a season. This is helpful, especially if it’s a first-time homebuyer waiting for their current lease to run out and they can’t move into the new home right away too.

Homebuyers can also offer free sale-leasebacks to make their offer more attractive to the home seller, making them more competitive in bidding wars. And, since 2024 is shaping up to be a still competitive market with low inventory, having an edge in the real estate transaction can help them stand out and get the house they want.

Sellers who live in their homes as renters don’t need to hire movers twice or put their belongings into expensive storage units. Overall, this clause in the sale agreement gives upfront benefits that suit different circumstances.

Living in Your House as a Renter after the Home Sale

When you live in your house as a renter after the home sale, you no longer have to pay a mortgage or have any responsibilities related to homeownership. However, as with all legal agreements, it’s important to speak with your realtor about your rights and responsibilities as a renter before you agree to one. It’s also helpful to get extra legal advice from a real estate attorney to make sure everything in the contract protects you.

Can sellers stay in their house after closing day?

Yes, sellers can stay in their house after closing day as long as all parties in the real estate transaction agree to a post-occupancy agreement in the purchase contract. If you have any questions on how to get this done or to start your new construction home search, talk to us today. We offer a Sell and Stay program that allows you to stay in your home as a tenant as long as you buy a new construction home with one of our builder partners.

How Sell and Stay helps people:

1. Provides Builders an Advantage

Builders are providing the fresh inventory homebuyers need in this tight market. A leaseback is a powerful tool because it allows buyers to move quickly on a new construction and allows home builder reps to secure deals in the face of limited inventory.

2. Buyers Don’t Have to Stress When Waiting for a New Build

A sale-rentback doesn’t just give buyers of new builds cash to close, but it also allows them to live affordably in their previous home until their new home is completed. This equity also allows them to close fast and make the most competitive offer that isn’t based on too many contingencies. The builder will be more likely to take the contract that doesn’t hang on too many unknowns, meanwhile, the buyer can take advantage of the best interest rates since they can put more money down and pay down their interest rate.

3. Helps Buyers of Fixer-Uppers

The timing between the closing date and moving into a new home can be too close for comfort when there are repairs to be made in the next home. However, a leaseback can buy the seller enough time to comfortably work on the new home while living affordably in their previous home. Having extra cash to flip the new home is icing on the cake.

4. Helps Investors Who Need Cash ASAP

A lump sum from a sale-leaseback can give an investor the money required to close on another property. The investor can also live in their old home and not waste time looking for another place to live. By including a buy-back clause, the seller can also get their old home back under certain conditions, which ultimately brings it back into their portfolio.

5. Helps Anyone Who Plans to Travel Long-Term

If you crave freedom and want to be free from the responsibility of maintaining your home, then a sale-leaseback can be the answer for you. Not only do you get a lump sum of cash to do with as you please, but you aren’t responsible for your property anymore and can plant your roots elsewhere — when you’re ready of course!

Living in Your Home after its Sale Closing Date

A sale-leaseback is a convenient and desirable option for home sellers since they can move on their timeline. It’s more common for buyers to offer sellers a leaseback agreement during the contract negotiation phase in a seller’s market.

Having extra time after closing day helps sellers plan moves just right, especially when they are waiting for a new construction home to be built and don’t want to move twice. Overall, a sale-leaseback like our Sell & Stay program allows you to sell and stay in your home, allowing you to move out when you’re ready.

A Sale-Leaseback with Real Life in Mind

If you’ve been entering search engine topics like “buy my house and rent it back to me,” then you may want to know all the ways renting back your home can benefit you. A sale-leaseback program converts your home equity to a cash lump sum and lets you stay in it as a renter.

When you have a busy lifestyle, simply eliminating the question of how to sell your home can take a big weight off your shoulders. There are many situations in which this program can assist you. Here are just a few.

- Free home equity from your home to pay off debt without moving.

- Use equity toward the down payment or closing costs of a new home but have a flexible move-out timeline for work-related or other personal reasons.

- Eliminate the home selling contingency and allow you to make an excellent down payment on a new house. This makes your offer more competitive and will enable you to pay down your future loan to get better interest rates.

- Have a comfortable place to live while your new construction home is built. There is no need to move twice, saving you thousands in moving truck and hotel costs.

- Get the freedom to move anytime with a guaranteed financial backup. No hassle of timing moves to the next home here!

- Become a short-term or long-term renter without moving, with the option to repurchase your home if your plans change.

- If you want to buy a new home but don’t want to have the deal depend on another open market buyer. The amount of time you save not juggling two sides of a transaction adds up!

- When you become a renter, you no longer have to worry about renovations, upkeep, property taxes, or other homeowner tasks.

“Sell and Stay” Program Specifics

The Sell and Stay program from Marketplace Homes provides the ultimate freedom and financial options for prospective buyers who need to make time-sensitive decisions. You just need to do one move-in and one move-out, making relocating easy.

Whether you need to pay off debt or position yourself for a quick move, this program allows you to use your current home to the fullest advantage. A real estate agent from our solutions team will help guide you through the process, explaining everything from your property’s value in the housing market to all your options within the Sell and Stay program.

1. Cash Upfront

We will front you a cash offer of up to 80% of your home’s appraised value and then give the remaining value after your sale-leaseback period is over (we will sell your home to back these proceeds).

Also, if the home goes up in value before we sell it and give the final cut, then you will keep 100% of the additional gains in home equity. This boosts mortgage lender confidence and makes it easier to look financially fit, a boon in a market when home prices are still surging and sellers still expect top dollar.

2. More Options

If you change your mind at any point and want your home back, you can buy back your home. Unlike lenders, Marketplace Homes can assist a broader range of homebuyers and sellers with different credit histories and income levels. This allows you to be flexible if the real estate market changes and affects your options.

3. Less Hassle

There’s no need to worry about marketing to potential buyers, open houses, paying for repairs after a home inspection, or your old mortgage payments. A sale-leaseback allows you to make your next home purchase with confidence because you won’t have to juggle the typical logistics like storage units and hotels that affect your personal finances.

As you can see, a sale-leaseback opens you to various options that can assist you on life’s many paths. This solution is also flexible enough to provide many options that work with your evolving needs. Whether you are on the fence about accepting a new job offer, are in a transitional period of life, or are aware that you need to upgrade or downsize, having your home already sold is a major convenience.

It’s one of the most advantageous real estate transactions for people who need freedom and the ability to cash into home equity. Talk to one of our realtors today to learn more about the Sell and Stay program!

A Confident Future

Sell & Stay gives everyone the confidence they can still close in the face of whatever economic nightmare is unfolding in the media this month. Think about it as a hedge against supply chain issues — and we’re here to help you every step of the way.

If you need more freedom in your finances and in your moving timeline, turning your home into a rental can be an excellent option. Marketplace Homes is poised to help people make the most of their home value with this unique Sell and Stay option. We will help you make the best decisions based on your home’s market value and offer an honest purchase price based on human-powered valuations.

Marketplace Homes is one of the best companies that buy your house and rent back to you. Why? We operate nationally, so state lines are no barrier to your real estate goals. With over 20 years of experience in various markets, we know what it takes to make your experience the best too. We also work with real estate investors who can make quick cash offers.

We also offer other guaranteed incentive programs like Guaranteed Purchase or Guaranteed Lease that serve as excellent financial backups. Through our many options, you can also test the open market to try and get your home’s full market value if you have time to list! For more information, contact us today!

Alicia Persson is a Content Strategist SEO writer at Marketplace Homes, utilizing previous years of experience on real estate teams that specialized in investments and property management. Before she joined Marketplace Homes, she was also a freelance writer for 7 years, leading to a specialization in real estate and home living content for boutique digital marketing agencies. During her writing years, she learned the basics of SEO and gained experience writing for many different clients, making her versatile at creating diverse content.

She is a proud University of Virginia master’s graduate and enjoyed her undergraduate years at the University of Mary Washington. When Alicia is not writing, she plays keytar and sings in a local 90’s rock cover band, or she spends time with her amazing family.