Can You Buy a New Construction Home without Equity?

It doesn’t take long to notice the endless talk about higher mortgage interest rates in the news. These headlines can be daunting for first-time home buyers, especially if you want a new home and don’t have home equity to back up your purchase?

However, we’re here to tell you that purchasing a new construction home without relying on equity is possible. With the right real estate agent, having enough cash to close, and financial stats to satisfy mortgage lenders, a home purchase can be in your future.

How Do You Buy a New Construction Home Without Home Equity?

While homeowners have the upper hand in buying a new construction home, you don’t need equity if you have the right financial profile. You can be a first-time homebuyer and get new construction too. Typically, lenders and builders would commit to a contract with a buyer with these things in place:

-

A strong credit score above 650 at least. The higher, the better.

-

A low debt-to-income ratio.

-

5-6 months of savings.

-

Ability to pay a 20% down payment (or handle extra PMI payments with a minimum of 5% down.)

-

If you own a home already: The ability to handle a second mortgage and property taxes on your new home.

While all this seems straightforward, having these conditions in place can take months to years. If you have new construction as a goal, it’s never too late to start saving and working on your credit profile.

The higher the home value, the more financial backup you will need to qualify. Upgrades like granite countertops, custom home design, and other fancy additions can drive a home price up.

To avoid any extra costs, check out spec homes, which are move-in ready new construction homes that have all the benefits of new home construction without the long wait or custom add-ons. Model homes may also come at a discount compared to other homes still undergoing the building process. Other factors like having a homeowners association (HOA) can push up costs, so keep this in mind as you shop around.

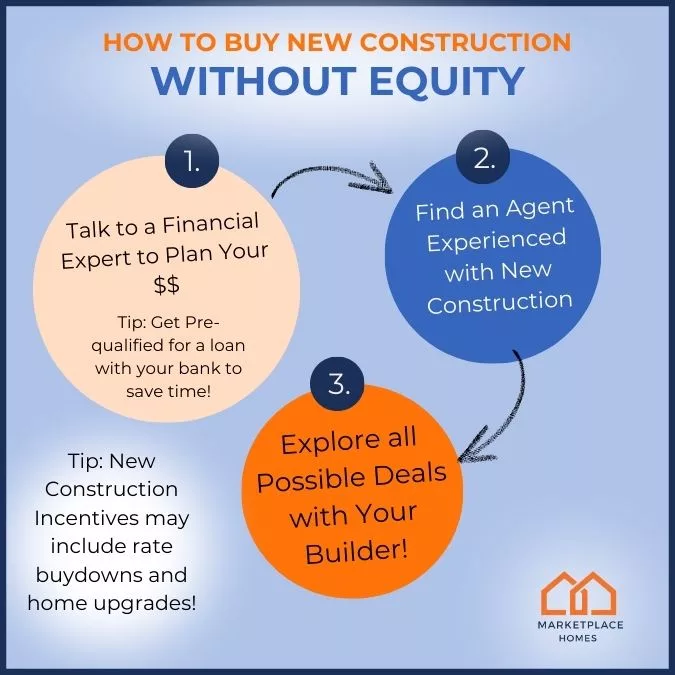

Step 1: Talk to Financial Experts

To know how hard you have to work, you must first talk to a lender and see where you stand. This doesn’t have to be your final lender either. It can be your bank. Test the waters and ask them for a pre-approval letter.

This process will require some time and paperwork, but you can get an accurate assessment of your tentative top dollar — or you may be told about some weak spots to work on before you can be presented with a letter.

If it’s within your means, consulting the expertise of a financial advisor can get you some incredible tips about saving and rehabbing any weak spots in your credit score or DTI. By knowing what to attack, you can get victory in the biggest areas of need sooner rather than later.

Typical Financial Benchmarks for Buying a New Construction Home

Down Payment Amount: The typical down payment for a new construction home without equity is 20%. This figure is essential to give the builder and the builder’s preferred lender enough confidence to proceed. How much is that? If you buy a $400,000 house, multiply that by 0.2 to get $80,000.

Credit Score: The higher, the better, but a minimum of 680 is typical. Being in the high 700s and into the 800s is optimal. When looking at your credit score, lenders will be looking to see if you have any past financial hardships and if you can maintain good standing with the debt that you have taken on.

Debt-to-income ratio: No higher than 45%. This means that after dividing your monthly debts by your net monthly income, the figure should be no higher than .45. For example, if you have a net monthly income of $5,000, but you have $2,500 of bills per month, your DTI is .5, or 50%, which is too high. (Naturally, your lender will also consider how you won’t have significant debts like your current rent if you plan to have the new construction home as your future primary residence)

Savings: Having a solid financial footing is equally as important. It is recommended that buyers set aside an additional 4-6 months of housing costs.

Step 2: Get a Real Estate Agent Who Is an Expert in New Construction Homes

Real estate agents who regularly work with new home builders can offer plenty of advice about buying a new construction home. When you have this pro on your side, you can gain these advantages that put a new house within your reach:

-

Expert advice on when and where to buy.

-

Insights on the right builder for you, with the best builder’s warranty and upfront deals with preferred lenders like mortgage rate buydowns.

-

An intermediary between you and the lender, granting you extra home loan qualification advice.

Working with an agent is crucial to buying a new construction home without equity because they will have the most tailored advice for your situation. When representing you, they will be the intermediary between you, the builder, and your lender.

While your lender prepares you financially for expenses like upcoming closing costs on your new construction loan, your realtor can help you get your dream home by finding a solution for your current home (if it doesn’t have enough equity) or assist you with the homebuying process as a first-time buyer.

Your financing options will depend on the lender you choose. Most people who pursue homeownership of a brand-new home opt to work with the builder’s preferred lender. This simplifies the process and allows your loan options to be tailored to your builder’s expectations and needs, which simplifies the path to owning a newly-built home.

Step 3: Get All the Deals You Can

You can access the best information about deals, incentives, and much more when you have done your financial homework and have solid real estate representation. Most builder discounts come through special incentives and mortgage rates from the builder’s preferred lender.

The builder’s preferred lender can cut exclusive deals to lower your expected mortgage payments through limited-time lower interest rates. Builders may also offer discounts and upgrades that are exclusive to their brand. Borrowers should shop around to compare rates and incentives. You should also listen to your realtor to get the best new build deals.

An experienced new construction real estate agent can get you the most out of your purchase agreement. Builder incentives like mortgage rate buydowns, free upgrades, and more can enhance the value of your future home while reducing monthly costs.

What to Know before Getting a New Construction Loan

Getting a loan for a new construction home is much like the process of qualifying for and acquiring a loan for an existing home. Here are some quick tips to follow before you commit:

Never skip the home inspection, even for a new home. Though it may seem like a formality, due diligence is still important to make sure your future home is ready and without defects. Even if a new home doesn’t need renovations, there can be

If you want to lower your monthly payment, pay enough of a down payment to eliminate mortgage insurance aka PMI. This charge can add $30-$70 on average for every $100,000 borrowed to your mortgage payment, which adds up.

Ask your builder about all the terms of their warranty. Many builders offer structural warranties that cover potential defects after you move in. Knowing the warranty terms can help you understand what’s covered in your custom home and for how long.

-

Note: a builder’s warranty is not to be confused with a home warranty, which covers select aspects of the home like appliances, not structural issues or major systems.

Have a solid foundation in your personal finances before you commit to purchasing a single-family home. Since you don’t have equity to back up your loan, you need to have strong backup assets to qualify for your own home. Thankfully, following the advice of a financial advisor can help you get to where you need to be.

Don’t settle! Even for inventory homes, builders have a variety of floor plans, design options, and sales price options so that you can strike the right balance with design, function, and value.

-

Note: Most builders don’t include extensive landscaping in the deal. So, don’t worry if your home doesn’t look exactly like you envisioned at first. But some builders may offer the perk of landscaping and fencing as part of add-ons to your purchase.

Offer the highest down payment that you are comfortable with. The more you put down now for your new construction home, the sooner you will be able to take out a home equity line of credit or cash-out refinance.

Buying New Construction Homes Without Equity Is Possible

Buying a new construction house without equity can be intimidating, but it isn’t impossible. Work closely with your realtor, builder sales rep, and lender to decide what home and mortgage loan type works for you and your financial situation. When you proceed cautiously and prepare well, a move-in day into an energy-efficient home can be in your future!

Alicia Persson is a Content Strategist SEO writer at Marketplace Homes, utilizing previous years of experience on real estate teams that specialized in investments and property management. Before she joined Marketplace Homes, she was also a freelance writer for 7 years, leading to a specialization in real estate and home living content for boutique digital marketing agencies. During her writing years, she learned the basics of SEO and gained experience writing for many different clients, making her versatile at creating diverse content.

She is a proud University of Virginia master’s graduate and enjoyed her undergraduate years at the University of Mary Washington. When Alicia is not writing, she plays keytar and sings in a local 90’s rock cover band, or she spends time with her amazing family.