How to Find Net Present Value for Your Investments

Before you make any financial decision, it’s important to determine whether it’s going to be worth your while. Although nobody can be absolutely clairvoyant, there are methods that you can use to calculate the potential profits of a buy and hold investment.

Net present value is one of the most valuable tools that a buy and hold investor can use. Through this calculation, you can find the time value of money that you invest into real estate rentals.

What is NPV, how do you calculate it, and how can you use it to your advantage in real estate Investments? We break down the basics so that you can make the most educated decisions about your acquisitions.

What is the net present value of an investment?

NPV is the number you come up with after subtracting the value of future cash flow from the present value of cash plus the initial investment. It essentially applies today’s dollar value to your future income stream from an investment.

This value determines whether today’s cash inflows will have a good rate of return after withstanding potential risks, inflation, interest rates, and other costs.

NPV examines whether your anticipated gains will exceed today’s dollar value of your investment. It’s the closest we can get to a crystal ball regarding the value of your investment.

If your NPV is positive, then your asset will likely have a positive cash outflow. If it’s negative, then your investment option hasn’t recouped what you initially put into it (but you can profit after disposition if the numbers work out).

“A dollar today isn’t the same tomorrow.”

The core theory behind NPV is that one dollar today is not worth the same in the future. You can almost always bet on inflation negatively impacting the future value of the money you have in the bank. Profits must exceed the initial cost and current value of the asset while considering that the future dollar won’t be as strong.

What’s a Good NPV?

When it comes to NPV, the higher the number, the better. Any positive net amount means you’re making money since the money made over time exceeds the initial startup cost. However, it is better to get a large profit vs. a minimal amount.

A negative NPV means your investment has not made enough money to exceed the initial investment. This means there isn’t a positive return on investment based on a set series of cash flows.

- Tip: Do calculate NPV based on different holding periods! Sometimes your NPV can be not so great with a short holding period, but then you can see profit if you hold it for a higher number of years. Ask a financial analyst for more detailed information!

How to Calculate Net Present Value in Real Estate

There are different NPV formulas used to offer you a financial analysis based on different holding periods. Overall, it’s easier to get a more accurate figure when the term is shorter.

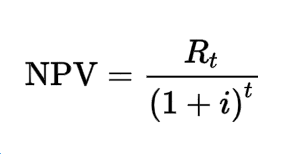

Net Present Value Formula

The following formula is one of the ways analysts calculate net present value.

- NPV= The value of today’s expected cash flows − Today’s value of invested cash.

To estimate the value of today’s cash in the future, you factor in a discount rate, which is the rate of interest used to discount all future cash flows. In other words, the discount rate helps investors determine what their future cash flows are worth compared to today’s dollar value in a discounted cash flow (DCF) analysis.

The higher the risk, the higher the rate. A common discount rate is 10%, also known as the “hurdle rate,” but it can be higher or lower based on your property’s unique profile.

To determine your property’s potential discount rate, speak with a real estate analyst. Crunching numbers like this helps you know if an investment decision is a good one.

Discount Rate Formulas

Like to DIY? Here are two main formulas used to calculate discount rates:

The weighted average cost of capital (WACC): WACC = E/V x Ce + D/V x Cd x (1-T).

Adjusted present value (APV): APV = NPV + Present Value of the impact of financing.

Want to find out what all those letters stand for and how these two formulas find the discount rate? Paddle’s blog on calculating a discount rate fleshes it all out in a streamlined manner.

Finding the Net Present Value in Real Estate Investments

Let’s dive into an example of how to apply these NPV functions to a fictional real estate investment.

Bob sees a single-family home that he wants to buy and hold. He pays $200,000 in cash and needs to do around $20,000 in repairs. The monthly rent is projected to generate around $2,000 per month, or $24,000 per year. He has no mortgage and therefore less risk.

Bob plans to hold this rental for five years, and then he hopes to sell it for $300,000. Without considering net present value, a novice investor would simply deduct cash out from cash in:

- Cash in: $300,000 (future sale) + (120,000) monthly rent for five years = $420,000

- Cash out: $200,000 initial purchase price + $20,000 repairs = -$220,000

$420,000 -$222,000= Net: +$200,000

Figuring in Discounted Cash Flow

However, figuring the discount rate into the equation gives Bob a more realistic picture of what to expect. After all, we can’t live in fantasy land and think that inflation, depreciation, or any other risk won’t happen to his single-family rental.

Regarding this investment, Bob’s analyst gives him a discount rate of 7%. We’re just using a number not based on any facts, so this rate can differ for your investment. Bob can then plug his yearly numbers into this convenient NPV calculator to factor in future cash flow with this discount rate.

Using this tool, he discovers that by year 5, the net present value comes to -$101,595.26. Based on these predictions, the investment can make Bob a fair amount of money if he plans to sell it for $300,000 in 5 years. $300k – $101,595.26 = $198,404.74. This is just under 200k in rental and disposition profits, which is nothing to scoff at, but is it worth it to sell yet?

What if Bob wanted more profit?

Let’s say that Bob revisits his disposition plan and decides to hold the investment for 10 years. With the same discount rate, and just keeping the same $2k rental rate per month, the single-family rental gets an NPV of -$31,434.04, which, when applied to a $300k sale, ends up being $268,595.96.

- Note: We are aware that the potential sale price for a home 5+ years in the future can be higher due to inflation, and we kept the rental rates static for the sake of simplicity. There is a LOT not figured in to make this fictional example more accurate, which makes it vital for you to seek the expertise of an analyst for a professional estimate.

NPV: Not to be confused with IRR

NPV is often used with another metric called IRR, or the internal rate or return. IRR is another formula that measures the return on a future investment, but it’s different. Instead of making a large section about this, here is Investopedia’s take on the difference.

Finding the Right Hold Time

Do you need to find the right hold time and rental price for a potential investment? Using the NPV online calculator is a great start. Also, keep in mind that the average discount rates are between 7.5% and 9.5%, so it’s better to play it safe and not use a rock-bottom discount rate to anticipate a rental’s value.

Overall, the less you invest and pay to maintain a property, the more freedom you have regarding rental prices and holding times. When you figure in a mortgage, your ultimate profit will be less compared to using all cash due to interest, but you can still create a strong portfolio over time!

To find out more about identifying profitable investment opportunities in our 30+ active markets, speak to a real estate professional at marketplace homes today.

Alicia Persson is a Content Strategist SEO writer at Marketplace Homes, utilizing previous years of experience on real estate teams that specialized in investments and property management. Before she joined Marketplace Homes, she was also a freelance writer for 7 years, leading to a specialization in real estate and home living content for boutique digital marketing agencies. During her writing years, she learned the basics of SEO and gained experience writing for many different clients, making her versatile at creating diverse content.

She is a proud University of Virginia master’s graduate and enjoyed her undergraduate years at the University of Mary Washington. When Alicia is not writing, she plays keytar and sings in a local 90’s rock cover band, or she spends time with her amazing family.