The Best Cities to Buy Investment Properties

In real estate investing, home prices, buyer demand, and seller activity are unique to local real estate markets. Various factors, like vacancy rates, rental prices, strong economy, and a low cost of living combine to determine whether rentals and/or house flipping would be profitable in a specific area too.

Though there are national averages in real estate, local home values can be vastly different depending on its amenities, job market, area’s population growth, and much more. Therefore, real estate investors heavily rely on up-to-date data about what cities and states are better bets for buying rental properties.

Which cities are positioned to give you the best rental yields and home flip profits? Our investors have properties in major cities and up-and-coming locations around the nation. Here are some of the favorite locations that are on our radar.

What are the best cities to buy rentals?

While this is just our short list, here are some housing markets in America that have favorable characteristics for increased investor activity. In no particular order, this is where we are seeing investor interest.

- Nashville TN

- Detroit, MI

- Birmingham, AL

- Charlotte, NC

- Fort Meyers, FL

In these cities, the rental markets are favorable for buy and hold investors. There are usually factors like a low unemployment rate, positive year-over-year growth in population and jobs, and reasonable housing prices. It doesn’t have to be the largest city in the state- in fact, you can find discount property values in up-and-coming areas. If you want to buy rental properties, these cities are worth a look.

Also, keep in mind that there can be opportunities where you least expect. This is not a definitive list of favorable locations. Other reports show places in Arizona, Georgia, Texas, Wisconsin, and beyond with favorable real estate metrics for investors.

Speak with your realtor to get some insights on locations you want to explore and enjoy the journey of finding new investment opportunities! And, as always, keep your financial advisor in the loop to implement the best methodologies to meet your investment goals!

5 Best Places for a Real Estate Investor in 2024

Though this isn’t a definitive list, these are definitely our top 5 at Marketplace Homes!

Nashville, Tennessee

- Median sale price for 3-bedroom house: $499.3K

Nashville is just a cool place, period, but it’s even more exciting that this hub of musical expression can also be a great place for investors. It’s also located in Tennessee, a state that is overall known for is encouraging job growth and low property tax rates. This is a boon for all homebuyers, including investors looking to diversify their rental income sources. All this job growth is fertile ground for renters, since many newcomers to the area may prefer to try out the city instead of buy right away.

According to Rocket Mortgage, Nashville is a “neutral market” which indicates reasonable prices and average time on the market for homes. Also, 58.7% of homes in Nashville sold below asking price in October 2023, which is hopeful news for investors looking to make cash offers at a discount.

Detroit, Michigan

- Median sale price for 3-bedroom house: $74.9K

The Motor City continues to make it on our list of favorite markets. Does it have anything to do with the fact that our headquarters happen to be there? Perhaps. Or, it could be its affordable housing? But we also just find the conditions are just right for investors, and our clients agree. Its super low average home price and increasing inventory marks it as a buyer’s market.

Investors who are used to spending much more for properties can more easily achieve favorable cash flow with less upfront costs. Our friends from Arrived also affirm these awesome real estate prices while adding that rentals are in high demand while properties continue to appreciate.

Birmingham, Alabama

- Median sale price for a 3-bedroom house: $174.9K

Recently, Birmingham has experienced nearly a doubling of home inventory and a shorter average listing time. The vast availability of properties with a lower median home price, especially homes in need of TLC, makes it fertile ground for investors to snag more single-family homes to convert as rentals.

For this reason, it’s a hub for fix and flip investors. As a major metropolitan area in Alabama, it’s experiencing significant economic growth. As this metro area grows, new residents demand rental properties and suitable places to live. Even with high interest rates, the lower-than-average cost of homes make becoming a homeowner significantly easier in Birmingham.

Charlotte, North Carolina

- Median sale price for a 3-bedroom house: $366.1K

Charlotte is one of the fastest growing cities in the south. In the last 10 years, its population has surged due to its growing amenities and things to do. Charlotte’s growing population is also young due to job growth, attracting more young people looking for career opportunities.

Charlotte is one of our best real estate investor spots because it offers a lot of value for locals. They have beach and mountain access and enjoy a cost of living that is around 5% lower than the national average.

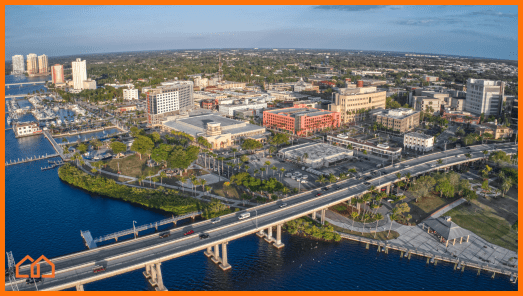

Fort Meyers, FL

- Median sale price for a 3-bedroom house: $413.7K

With Florida being a rental-friendly state in general, it’s no surprise that this list contains a gem with some shorefronts. Fort Meyers is currently experiencing a buyer’s market in which more than 80% of homes sell below asking price. It also has a noticeable job growth rate and population growth. Fort Meyers is known for its ample outdoor recreating, excellent growth potential in jobs and its local economy, and of course, it’s beautiful year-round weather. Build-to-rent is also on the rise here, as Southern Impression Homes explains more in its Fort Meyers Market Report.

Best Cities to Buy Investment Properties

These markets are just a sample of the opportunities that are hiding in plain sight in spite of a tumultuous past year of real estate changes. You can find many more opportunities by investigating recent market reports from local experts. States like Colorado, Ohio, Florida, Arizona, and Texas are often on investors’ radars too. San Antonio, Raleigh NC, Columbus OH, and Houston TX are just some places to Google for starters!

As mortgage rates continue to be high like last year, more Americans are likely to rent in 2024. Speak with your real estate agent to see what kind of properties can enhance your portfolio. You may also explore alternative opportunities like investing in short-term rentals, REITs, or multifamily properties!

Alicia Persson is a Content Strategist SEO writer at Marketplace Homes, utilizing previous years of experience on real estate teams that specialized in investments and property management. Before she joined Marketplace Homes, she was also a freelance writer for 7 years, leading to a specialization in real estate and home living content for boutique digital marketing agencies. During her writing years, she learned the basics of SEO and gained experience writing for many different clients, making her versatile at creating diverse content.

She is a proud University of Virginia master’s graduate and enjoyed her undergraduate years at the University of Mary Washington. When Alicia is not writing, she plays keytar and sings in a local 90’s rock cover band, or she spends time with her amazing family.