The one thing you can count on in the real estate market is that nothing ever, ever stays the same. As 2023 comes to a close, the leadership at Marketplace Homes respond to some popular predictions about the coming year based on what we’ve seen in the past 12 months. For starters, here is a “big picture” insight from our President, Will Dickson:

“The potential market outcomes for 2024 has a very wide range considering interest rates, inflation, inventory and other factors. We’re all subject to “Mr. Market” and interest rates seem to have broken underwriting in the short term. While rates or pricing has to adjust to get more deals done, there’s a lot to be excited about in the coming year. Development costs are becoming more predictable and demand for SFR/BTR remains extremely strong. The underlying fundamentals remain extremely strong and are going to continue driving long term growth in our industry. We think the current imbalance between rates and pricing will prove to be short term, and there should be more opportunities in 2024.”

What Is the Internet Saying + Our Responses?

Here are what the experts across the internet are saying about potential 2024 market trends – and what the real estate pros at Marketplace Homes think about it!

1. “2024 home prices will continue to rise.”

- Do we agree? Yes!

Though prices did dip in 2023, trends show them rising again due to tightened demand. Therefore, most experts predict rising prices in 2024 in most U.S. cities, but this time at a slower pace in line with traditional home value increases. Lawrence Yun, Chief Economist of the National Association of Realtors, predicts a 3-4% increase compared to last year. You can blame the ongoing housing shortage for this not-so-desirable trend.

“Low housing supply is a notable trend in the market. The shortage of available homes has created intense competition among buyers, resulting in increasing home values. This is a favorable condition for sellers but can be challenging for buyers.” Elyse S., Leasing Operations Manager

2. “The low Inventory of homes will persist.”

- Do we agree? To a degree.

Many experts in these end-of-year reports predict that there will still not be enough homes for buyers. According to Freddie Mac, we are currently short 1.5 to 3.4 million homes. A lower housing inventory is likely to plague the U.S. into 2024, making bidding wars an unfortunate thing to prepare buyers for, especially in more affordable home price brackets.

However, we’ve noticed that the recent slowdown of buyer activity has led to a growing number of homes on the market, though there are still 3.5% fewer homes compared to last year.

3. “Mortgage rates will fall and stick around the 6% range.”

- Do we agree? No, but we hope we’re wrong!

Higher interest rates have been a thorn in the side of many buyers and real estate agents since early 2023, making it harder for first-time homebuyers to buy a home. While some experts predict that the high 7s and low 8s that we see now can dip back to 6%, others are not sure about that. But is this low enough?

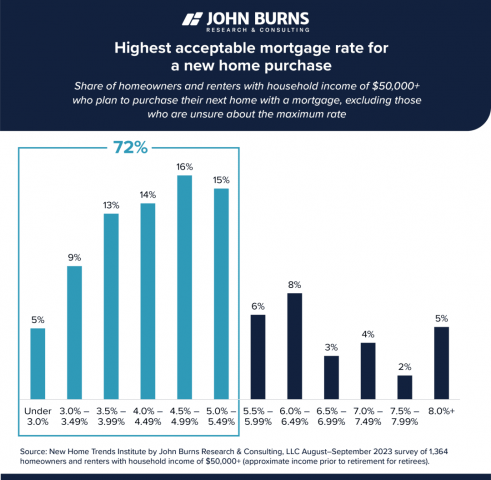

A recent survey by John Burns revealed that most people would be willing to buy if rates get in the 5% range, this will mean a lot of would-be home sellers will still be waiting for mortgage rates to drop before they make their move.

Source: John Burns Research & Consulting

“Although interest rates are on the rise, they are still historically low. This can make homeownership appealing to those who can secure favorable lending terms. Additionally, lending programs and refinancing options can help mitigate the impact of higher rates.” Elyse S., Leasing Operations Manager

“This doesn’t seem likely for 2024,” Andy S., CRO of Marketplace Homes

4. “The housing market will remain competitive due to various shortages.”

- Do we agree? Yes!

Multiple experts predict that the heat of the market will stay on in spite of the rate hikes and a growing supply of homes. Strong job growth, population growth, and limited land and labor to build is keeping median home prices from slumping and competition fierce.

The U.S. News Housing Market Index and National Association of Home Builders predict this shortage will continue into the end of the 2020s, keeping the seller’s market alive in the majority of markets.

Lawrence Yun, chief economist of the NAR, says that “there are simply not enough homes for sale.”

“Many builders and prospectors are scratching their heads about future land purchases. Many markets exploded in growth during Covid but have since corrected and lost potential as Return to Office policies made working from anywhere a little less realistic. The question is where we can get land that will serve the needs of the still-commuting office populations.” -Andy S, CRO

5. “There will be no “crash” like 2008.”

- Do we agree? Yes!

Just like fetch, that crash Gen Z and Millennials want isn’t likely to happen. Single-family homes are at a historical shortage, keeping prices high and stable, and even potentially growing into 2024. Many experts aren’t expecting a US housing market crash. People hoping to buy a new home must understand that low inventory prevents today’s conditions from resembling anything like 2008 and 2009. Why? Lending standards also stricter compared to 2008, as lenders have learned a lot from the recession to prevent more defaults and foreclosures. In addition, our labor market is stronger compared to 2009.

“While the rates remain high and affordability low, we still have a landscape where most homeowners are under 6% on their loans and equity-positive on their homes. Unemployment is under half what it was during the Great Recession. What we don’t wish to find is the tipping point, hopefully we can see the edge before we’ve gone over.” -Andy S., CRO

6. “Buyers + renters continue to feel the pinch.”

- Do we agree? Yes!

Next year, everyone will continue to feel the financial burn that amped up in 2023. Mortgage Rates will still be high enough to disrupt homebuying affordability. People who bought at lower rates will be more likely to not sell their homes, which push more would-be buyers into the rental market, upon which landlords are still putting upward pressure.

“One of the most prominent features of the current rental market is the consistent desire for homeowners to push increased rental prices, while rental values are actively falling year over year in most markets. This desire can be attributed to multiple factors, including the rising costs associated with homeownership, such as property taxes and insurance. Homeowners often pass on these increased costs to renters, making rental properties more expensive despite a renter’s ability or willingness to pay those increased costs,” – Elyse S.

“I am seeing an increase in the portions of the 55+ year old population that won’t sell because their home values have dropped since mid 2022 and they are cash poor and house rich and need every dollar from their home sale to afford community living,” Todd C., VP of Adult Living and Institutional SFR Investment Management

Marketplace Homes 2024 Real Estate Market Predictions

Not only did we take the time to speak to the most common predictions, but our team also had a few ideas of their own.

1. We’ll be rental people, in a rental world.

As more buyers are pushed out of the real estate market by high fixed-rate mortgages and slim pickings for forever homes, rentals will be a crash pad for many would-be homeowners.

“The high mortgage rates, currently at 8%, are another factor impacting the real estate market. These rates are significant and are likely to continue rising, potentially deterring people from buying homes. This could lead to more individuals choosing to rent instead of purchasing homes, which might increase demand for rental properties.” Elyse

But residents don’t want to live just anywhere.

“While rental rates may be lower than in recent years, safe, clean, and affordable housing remains in high demand. Property management companies and landlords have the opportunity to attract quality tenants. However, the product quality must match the price.” Elyse S.

2. The rental market is currently in a stabilization phase.

When prices are too high for people to afford them, suppliers must adjust. The same goes for commodities like rentals. This prompts a need for market correction, which could happen in 2024, as our experts have already seen a dip in rental prices.

“The rise in rent rates is concerning because it is not matched by a corresponding increase in income for prospective tenants. This discrepancy has resulted in rental properties becoming increasingly unaffordable for many individuals and families. It’s essential to recognize that housing affordability is a critical issue that affects a wide range of people. Landlords need to strongly consider setting more reasonable rental prices that match the current market. It is no longer the boom we saw over past few years.” -Elyse S.

3. Sellers must accept concessions to sell their homes.

Today’s sellers may still not be fully adjusted to the increased difficulty in selling homes as-is. While this was common in the hot seller’s market of 2021- to early 2022, higher prices have caused buyers to be pickier. If your home needs some TLC, you must accept a price decrease or other seller concessions to get to the closing table.

“I am seeing an uncanny of distressed sellers that would sell to investors that are looking for unreasonably high prices for their homes even though the homes need renovations etc. Distressed seller sales expectations aren’t always aligning with the mesh of product and price in today’s market.” Todd C., VP of Adult Living and Institutional SFR Investment Mgmt.

4. We must remain optimistic and look for the opportunities in new builds and BFR.

“It’s essential to maintain a positive outlook regarding the economic climate. Despite rising interest rates, there are still opportunities for both buying and selling real estate. Those with the resources continue to buy and build homes, and there is a window of opportunity for those interested in selling or buying.” Elyse S.

Opportunities come in many forms, such as working with the nation’s top builders, who are actively providing more housing inventory in a market that desperately needs it.

5. Seniors are engaging more with tech in buying and selling real estate.

“The 55+ year old population is increasingly engaging technology and new ways of selling,” Todd C., VP of Adult Living and Institutional SFR Investment Management.

2024 Housing Market Predictions

Housing prices, inventory, affordability, mortgage interest rates, price growth or declines, and buyer expectations are all in flux. These individual variables combine to create a seller’s market, buyer’s market, or a hybrid of both – demanding real estate agents to be nimble and adaptable. What do you think is in store for the real estate market in 2024?

Marketplace Homes Guaranteed Sale Program in Action

At Marketplace Homes, we offer a Guaranteed Sale Program to provide property owners a reliable option to sell their homes quickly and with minimal hassle. Here's a description of how the program works: Initial Assessment: Homeowners interested in the Guaranteed Sale...

5 Little-Known Homebuying Secrets

Hiding in Plain Sight: 5 Secrets That Make Buying a Home More Affordable There are opportunities all over the place to make the path to homeownership easier. Other people are taking advantage of these real estate opportunities, so why not you? Here are 5 secrets that...

Multi-Family Homes Trend in 2024

The Multi-Family Revival How are Americans reacting to still-high interest rates like last year, fierce competition with hopeful renters and single-family homebuyers, and an ongoing affordability crisis? The answer lies in Multifamily Housing. In a challenging housing...

Alicia Persson is a Content Strategist SEO writer at Marketplace Homes, utilizing previous years of experience on real estate teams that specialized in investments and property management. Before she joined Marketplace Homes, she was also a freelance writer for 7 years, leading to a specialization in real estate and home living content for boutique digital marketing agencies. During her writing years, she learned the basics of SEO and gained experience writing for many different clients, making her versatile at creating diverse content.

She is a proud University of Virginia master’s graduate and enjoyed her undergraduate years at the University of Mary Washington. When Alicia is not writing, she plays keytar and sings in a local 90’s rock cover band, or she spends time with her amazing family.