What Are Homes Selling for in My Area?

“What are homes selling for in my area?” is a common question homeowners ask their realtor before they list their home for sale. It’s also a wise question for buyers to ask when they’re looking for real estate in a particular market. Knowing the average price of your property or the home you want helps you prepare for every facet of your upcoming real estate transaction.

A comparative market analysis, also known as a CMA, or an appraisal are necessary to find a property’s market value. Though you can do a light version of it by doing your own research with internet listings, you will get the best results when you get a CMA or appraisal from real estate professionals.

“What’s my home worth?”

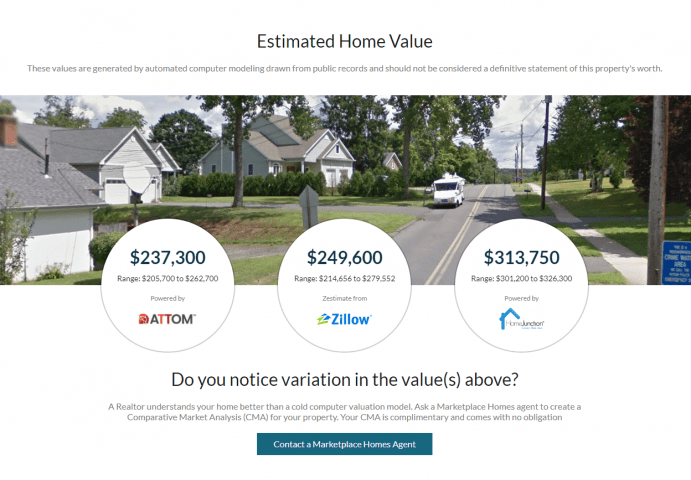

If you want answers ASAP, you can also use this quick and handy home valuation tool, sourced by our partners at Findbuyers.com. It’s extremely handy. All you have to do is enter your address then click on the auto-filled address that appears below. Then, you’ll get several instant home value estimation quotes, which you can fine-tune when you verify ownership and enter additional information about the home’s condition.

What’s a Comparative Market Analysis?

A comparative market analysis is a detailed report that uses current real estate data to estimate the market value of a property. It is often calculated by finding like properties, also known as “comps”, that have sold within the same neighborhood or focused area in the past 6 months.

The more comps you can find, the better for generating an accurate assessment of the property’s market value. For the best results, comps should be restricted to the same neighborhood and have the same number of rooms, square footage, and level of amenities. To get up-to-date information on sold homes, real estate agents usually use the Multiple Listing Service, aka MLS.

For example, a 4-bedroom colonial house with a 2-car garage is not a good comp for a 3-bedroom rambler with no garage, even if it is in the same neighborhood. Ideally, you should match it with homes of the same caliber that recently sold.

If there are no viable comps in the same neighborhood, you can use the price per square foot for homes that recently sold in the same neighborhood. With this method, you’d multiply the average price by the square foot of homes sold by the square footage of the home you want to value. However, you should also keep in mind factors like the condition of the home and other features that the home may have that comps don’t, like a swimming pool or guest house.

How to Find out What Homes Are Selling for Quickly

If you are curious about finding out what homes are going for in your area but aren’t ready to speak with a realtor, you can do a quick check yourself. It won’t be as comprehensive, but you can get a general idea of what your house can go for. The first rule of thumb is to not trust valuation estimates on home sites off the bat. Often, these estimates lean high and can disappoint home sellers when the reality of a solid CMA and/or appraisal sinks in.

To do a quick check of your home’s market value, go on any house-selling directory site like Zillow, Realtor.com, Redfin, etc. Next, look for homes recently sold in your neighborhood in the past 6 months. Unfortunately, many of these sites don’t get the final official sale price of the home until some time has passed. You can see what the house’s listing price was, but there are often price adjustments during the due diligence period because of seller concessions or the appraisal. However, you may get a general idea of what your home could list for.

What’s the Difference Between an Appraisal and a CMA?

The key difference between an appraisal and a CMA is that a realtor conducts a CMA and an appraiser does the appraisal. Both are evaluations that take numbers from the property’s comps to determine market value. It’s in the interest of both the CMA and appraisal to get the most accurate market value. Your agent wants to get the right price so the house sells quickly, while the appraiser, who represents the lender/bank, wants to ensure that the lender isn’t giving too much money for the home. Since mortgage lenders will not lend any amount that exceeds the appraisal, it’s important for the appraiser to get an accurate assessment of the home’s value.

Due to this need for exact home value, the appraisal tends to dig a little deeper and evaluate the property’s specific condition. The age of its roof, interior conditions, age of HVAC, condition of windows, doors, and other major and minor elements all combine to make a valuation. Since realtors don’t want any deal to fall through because the lending won’t cover the house’s price, they will also be diligent with their CMAs to produce a number similar to the appraisal. It is up to the home seller to listen to their realtor’s advice when they list so they don’t go overboard with their listing price.

Can Neighborhoods Affect Home Values?

Yes, a neighborhood can directly influence a house’s market value. For example, a house under foreclosure can negatively impact other properties within 660 feet from it. Everything from your neighbors’ curb appeal, the noise volume in your area, the quality of local schools, to the number of renters in your vicinity all move the price needle up or down.

This is a prime example of how there can be submarkets within a local market with different home valuations. Even two neighborhoods in the same city can have different average sale prices for a 3-bedroom house. Finding accurate home values is the job of a professional skilled in the art of identifying what factors bring a home’s value up or down.

Get a Free Comparative Market Analysis at Marketplace Homes

You don’t need to commit to selling or buying a house to get a professional comparative market analysis. If you are curious about taking the first steps with a real estate transaction, our experienced real estate agents can evaluate a property by utilizing our proprietary system alongside other industry-leading valuation software and historical data. This is a service that goes beyond just using the MLS, integrating groundbreaking technologies to make even more accurate and valuable home valuations for our clients.

Alicia Persson is a Content Strategist SEO writer at Marketplace Homes, utilizing previous years of experience on real estate teams that specialized in investments and property management. Before she joined Marketplace Homes, she was also a freelance writer for 7 years, leading to a specialization in real estate and home living content for boutique digital marketing agencies. During her writing years, she learned the basics of SEO and gained experience writing for many different clients, making her versatile at creating diverse content.

She is a proud University of Virginia master’s graduate and enjoyed her undergraduate years at the University of Mary Washington. When Alicia is not writing, she plays keytar and sings in a local 90’s rock cover band, or she spends time with her amazing family.